AngloGold Ashanti PLC Ordinary Shares (AU)

103.95

+5.36 (5.44%)

NYSE · Last Trade: Feb 7th, 10:41 AM EST

Detailed Quote

| Previous Close | 98.59 |

|---|---|

| Open | 102.56 |

| Bid | 103.95 |

| Ask | 104.40 |

| Day's Range | 102.13 - 105.76 |

| 52 Week Range | 28.45 - 115.81 |

| Volume | 2,733,024 |

| Market Cap | 43.17B |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 3.640 (3.50%) |

| 1 Month Average Volume | 3,254,722 |

Chart

About AngloGold Ashanti PLC Ordinary Shares (AU)

AngloGold Ashanti is a global mining company that focuses on the exploration, extraction, and production of gold. With operations across multiple countries, it engages in the entire gold mining process, from locating potential mining sites to processing the ore and delivering refined gold products. The company emphasizes sustainable and responsible mining practices, aiming to minimize environmental impact while contributing to the communities in which it operates. Through its diverse portfolio of mines, AngloGold Ashanti plays a significant role in the global gold market, catering to both investment and industrial demands. Read More

News & Press Releases

The global financial landscape reached a staggering milestone on January 26, 2026, as gold prices surged past the $5,000 per ounce mark for the first time in history. The precious metal, long considered the ultimate safe-haven asset, witnessed a dramatic daily rip of 1.41% to 1.95%, signaling

Via MarketMinute · January 27, 2026

As of January 27, 2026, the global financial architecture is undergoing a seismic shift, with gold re-emerging as the primary arbiter of value in a fractured geopolitical landscape. Driven by the escalation of the "Greenland Trade War" and a systematic pivot away from the U.S. dollar, central banks and

Via MarketMinute · January 27, 2026

ANGLOGOLD ASHANTI PLC (NYSE:AU) Shows High Growth Momentum and Strong Technical Healthchartmill.com

Via Chartmill · January 22, 2026

AngloGold Ashanti PLC (NYSE:AU) Fits the 'Affordable Growth' Investment Profilechartmill.com

Via Chartmill · January 19, 2026

AngloGold Ashanti (NYSE:AU) Shows Perfect Technical Rating and High-Quality Breakout Setupchartmill.com

Via Chartmill · January 12, 2026

AngloGold Ashanti (NYSE:AU) Combines High-Growth Momentum with Bullish Technical Setupchartmill.com

Via Chartmill · January 9, 2026

As the price of gold shatters historical records, reaching a staggering $4,600 per ounce, the world’s two largest gold producers are locked in a high-stakes corporate standoff that could redefine the global mining landscape. Rumors are swirling across Wall Street and Bay Street that Newmont Corporation (NYSE: NEM)

Via MarketMinute · January 20, 2026

The global financial landscape reached a fever pitch this Monday, January 19, 2026, as precious metals shattered all previous records. Gold surged to a staggering $4,700 per ounce, while Silver broke past the $93 mark, fueled by a perfect storm of aggressive U.S. foreign policy and a weakening

Via MarketMinute · January 19, 2026

Via MarketBeat · January 19, 2026

ANGLOGOLD ASHANTI PLC (NYSE:AU) Shows Strong Fundamentals and Technical Setup for Growthchartmill.com

Via Chartmill · January 6, 2026

As of January 13, 2026, the global financial landscape is witnessing a historic structural repricing of precious metals. Gold has shattered expectations, surging past the $4,600 per ounce mark, while silver has accelerated into "price discovery" territory, trading north of $85 per ounce. This vertical ascent has finally ignited

Via MarketMinute · January 13, 2026

ACCRA, Ghana — In a stunning reversal of a decades-long trend of devaluation, the Ghanaian Cedi has closed 2025 as one of the world’s strongest-performing currencies, marking its first annual appreciation against the U.S. Dollar in 32 years. This historic rally, fueled by a relentless surge in global gold

Via MarketMinute · December 31, 2025

The final trading week of 2025 has been marked by a dramatic "flash crash" in the precious metals sector, as a series of aggressive margin requirement hikes by major exchanges brought a parabolic rally to a screeching halt. On December 29, 2025, gold and silver prices plummeted from historic highs,

Via MarketMinute · December 29, 2025

Everyone's selling silver and gold today, but with Anglogold profits poised to surge 73%, selling today is probably a mistake.

Via The Motley Fool · December 29, 2025

These three stocks delivered high yields and high performance this year.

Via The Motley Fool · December 28, 2025

As the calendar turns toward the end of 2025, the financial world is witnessing a historic surge in the precious metals sector, with gold prices shattering previous records to trade consistently above the $4,500 per ounce mark. At the center of this "Golden Renaissance" is Franco-Nevada Corporation (NYSE: FNV)

Via MarketMinute · December 24, 2025

Anglogold Ashanti (AU) exemplifies GARP investing with strong earnings growth, a reasonable valuation, and solid financial health.

Via Chartmill · December 23, 2025

As the sun sets on 2025, the bustling markets of Accra are breathing a sigh of relief that seemed impossible just twelve months ago. On December 22, 2025, Ghana’s economic narrative has shifted from a cautionary tale of debt distress to a remarkable, if fragile, recovery. The Ghanaian Cedi,

Via MarketMinute · December 22, 2025

In a historic session for the precious metals market, AngloGold Ashanti (NYSE: AU) soared to an all-time high of $89.37 on December 22, 2025. This milestone marks a staggering 292% year-to-date gain for the mining giant, a performance that has not only redefined the company’s valuation but has

Via MarketMinute · December 22, 2025

AngloGold Ashanti rode the gold price acceleration wave to a 245% return this year.

Via The Motley Fool · December 21, 2025

Anglogold Ashanti (AU) presents a value investing opportunity, combining strong fundamentals, profitability, and growth potential with a currently undervalued stock price.

Via Chartmill · December 19, 2025

As 2025 draws to a close, Franco-Nevada Corporation (TSX:FNV) (NYSE:FNV) has solidified its position as the premier vehicle for precious metals exposure, orchestrating a remarkable financial turnaround that has captivated Wall Street and Bay Street alike. Following a tumultuous 2024 defined by geopolitical friction and the shuttering of

Via MarketMinute · December 18, 2025

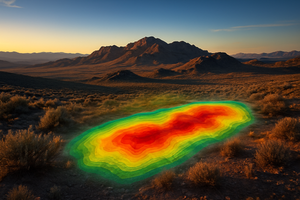

RENO, NV — In a move that underscores the intensifying gold rush within the Walker Lane trend, Black Mammoth Metals Corp. (TSXV: BMM) (OTC: LQRCF) announced today, December 18, 2025, the strategic acquisition of the Mustang Gold and Silver Property in Nye County, Nevada. The acquisition, executed through the staking of

Via MarketMinute · December 18, 2025

AngloGold Ashanti (AU) stock shows strong technical momentum and a high-quality setup, signaling a potential breakout entry for trend-following investors.

Via Chartmill · December 16, 2025

Global markets are currently grappling with a complex and often contradictory landscape in commodity prices, driven by a confluence of geopolitical tensions, persistent supply chain disruptions, and evolving economic policies. As of December 2025, a "great divergence" has become the defining characteristic of the commodity sector. While some commodities, particularly

Via MarketMinute · December 17, 2025