NVIDIA Corp (NVDA)

191.13

-1.38 (-0.72%)

NASDAQ · Last Trade: Feb 1st, 7:25 PM EST

Detailed Quote

| Previous Close | 192.51 |

|---|---|

| Open | 191.21 |

| Bid | 190.21 |

| Ask | 190.25 |

| Day's Range | 189.47 - 194.49 |

| 52 Week Range | 86.62 - 212.19 |

| Volume | 179,490,683 |

| Market Cap | 4.64T |

| PE Ratio (TTM) | 47.31 |

| EPS (TTM) | 4.0 |

| Dividend & Yield | 0.0400 (0.02%) |

| 1 Month Average Volume | 164,673,267 |

Chart

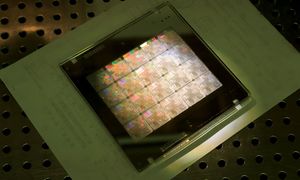

About NVIDIA Corp (NVDA)

NVIDIA Corporation is a leading technology company primarily known for its innovations in graphics processing units (GPUs) that enhance visual computing across various applications, including gaming, professional visualization, and artificial intelligence. Beyond its strong presence in gaming, NVIDIA's products are integral to deep learning and data center solutions, empowering advancements in machine learning, autonomous vehicles, and high-performance computing. By leveraging its cutting-edge technologies, NVIDIA aims to drive the future of computing and improve experiences across industries, from entertainment to scientific research. Read More

News & Press Releases

This healthcare technology firm develops robotic surgical systems for minimally invasive urology procedures targeting BPH treatment.

Via The Motley Fool · February 1, 2026

After tremendous gains, do Nvidia's revenue and stock price have room to run?

Via The Motley Fool · February 1, 2026

The main theme in Nancy Pelosi's stock investments remains "betting big on AI."

Via The Motley Fool · February 1, 2026

FLXR is an actively managed ETF providing diversified exposure to global fixed income markets through a flexible, multi-sector approach.

Via The Motley Fool · February 1, 2026

Wintrust Financial operates a diversified banking and specialty finance business across the Midwest and select Florida markets.

Via The Motley Fool · February 1, 2026

Focused on ultra-short U.S. Treasury exposure, VBIL targets liquidity and capital preservation for institutional and individual investors.

Via The Motley Fool · February 1, 2026

Nvidia's infusion supports a major customer, but CoreWeave still has debt.

Via The Motley Fool · February 1, 2026

AI infrastructure spending could eclipse $500 billion this year.

Via The Motley Fool · February 1, 2026

AMD is excited about its growth prospects for 2026.

Via The Motley Fool · February 1, 2026

Billionaires regularly pile more of their money into the biggest winners.

Via The Motley Fool · February 1, 2026

Taiwan Semiconductor Manufacturing looks like an AI top performer.

Via The Motley Fool · February 1, 2026

Prologis can make a lot of money developing AI data centers over the coming decade.

Via The Motley Fool · February 1, 2026

There are plenty of strong growth and value stocks available to buy right now.

Via The Motley Fool · February 1, 2026

Advanced Micro Devices is swiftly becoming a major source of parallel processing power for hyperscalers.

Via The Motley Fool · February 1, 2026

Nvidia and CoreWeave have a close relationship.

Via The Motley Fool · February 1, 2026

Technology stocks are likely to continue leading the broader market higher in 2026, fueled by the artificial intelligence boom.

Via The Motley Fool · February 1, 2026

As of February 1, 2026, the global financial landscape has been fundamentally rewired by a concept once relegated to the fringes of crypto-economic theory: Information Finance, or "InfoFi." What began as a tool for political junkies to hedge election risks has evolved into the world’s most potent data transmission mechanism. Prediction markets have transitioned from [...]

Via PredictStreet · February 1, 2026

Micron stock has gained 327% over the last 12 months thanks to soaring demand for memory from data center operators.

Via The Motley Fool · February 1, 2026

The traditional news ticker is undergoing a radical transformation. As of February 1, 2026, the familiar crawl of stock prices and weather updates has been joined—and in some cases replaced—by a far more dynamic metric: real-time "wisdom of the crowd" probabilities. From the halls of the U.S. Congress to the red carpets of Hollywood, prediction [...]

Via PredictStreet · February 1, 2026

Nvidia CEO Jensen Huang warns that young adults today are too informed and cynical, lacking the time for optimism and resilience.

Via Benzinga · February 1, 2026

Nvidia's stock is set to crush the market again in 2026.

Via The Motley Fool · February 1, 2026

It's built to flourish with or without current AI hype.

Via The Motley Fool · February 1, 2026

This ETF has tech companies leading the way with a built-in hedge.

Via The Motley Fool · February 1, 2026

CoreWeave could quadruple its revenue in the next two years.

Via The Motley Fool · February 1, 2026

Nancy Pelosi’s $5 million Disney sale contrasts with insider buying and a 23% analyst upside case, leaving DIS looking more like a slowly improving restructuring story than a broken business.

Via Barchart.com · February 1, 2026